Why Mortgage Lenders in Omaha Are Trick to Getting the Best Offer

Why Mortgage Lenders in Omaha Are Trick to Getting the Best Offer

Blog Article

Locate the Perfect Home Loan Broker for Your Mortgage Demands

Picking the appropriate mortgage broker is an essential action in the home funding process, as the know-how and resources they supply can dramatically impact your economic end result. Understanding where to begin in this search can often be overwhelming, raising the question of what details high qualities and qualifications really set a broker apart in a competitive market.

Understanding Home Loan Brokers

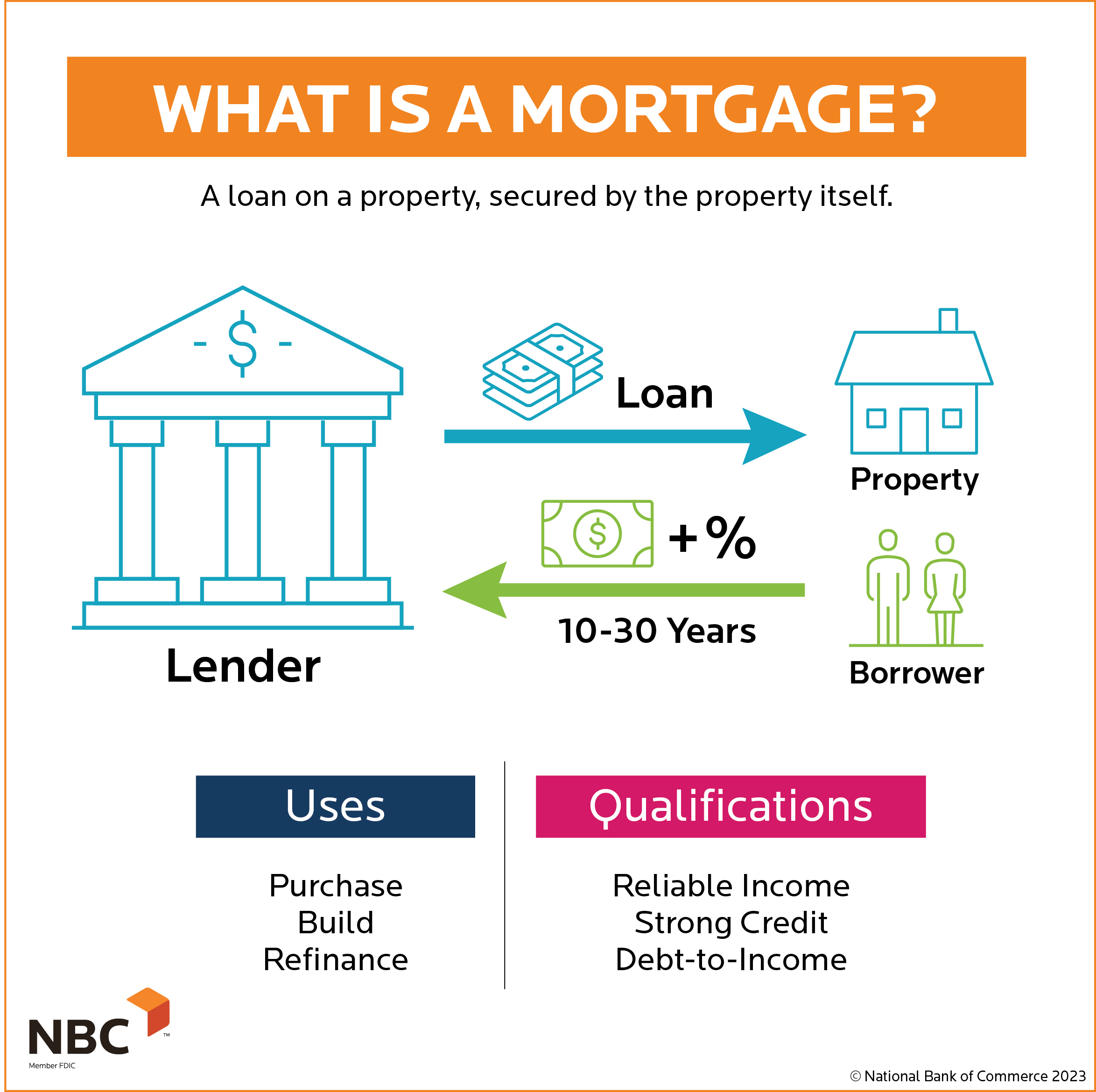

Recognizing home mortgage brokers is essential for navigating the intricacies of home funding. Home loan brokers act as intermediaries between borrowers and loan providers, assisting in the procedure of safeguarding a mortgage. They have considerable knowledge of the lending landscape and are competent at matching clients with suitable car loan items based on their economic accounts.

A vital feature of home loan brokers is to evaluate a borrower's monetary situation, consisting of credit ratings, revenue, and debt-to-income proportions. This evaluation allows them to recommend home loan choices that line up with the consumer's abilities and demands. Furthermore, brokers have access to a selection of lending institutions, which enables them to present several lending alternatives, potentially causing more favorable terms and rates.

Additionally, home mortgage brokers enhance the application process by aiding with the necessary paperwork and interaction with the lender. Their expertise can also prove important in browsing regulatory requirements and industry changes. By making use of a home mortgage broker, borrowers can conserve time and decrease stress and anxiety, ensuring a much more reliable and enlightened home funding experience. Understanding the role and advantages of mortgage brokers eventually encourages property buyers to make informed choices throughout their home mortgage journey.

Secret Qualities to Search For

When picking a mortgage broker, there are numerous vital qualities that can substantially affect your home funding experience. Look for a broker with a strong online reputation and favorable client reviews. A broker with satisfied customers is likely to offer dependable service and audio advice.

In addition, experience is crucial. A broker with comprehensive sector knowledge will be much better equipped to navigate intricate home loan choices and supply customized options. It is also essential to assess their interaction abilities. A broker who can clearly clarify terms and processes will certainly guarantee you are knowledgeable throughout your mortgage trip.

Another essential high quality is transparency. A reliable broker will openly talk about charges, possible disputes of passion, and the whole loaning procedure, allowing you to make educated decisions. Look for a broker that shows solid settlement skills, as they can protect better terms and prices in your place.

Last but not least, consider their schedule and responsiveness. A broker who prioritizes your demands and is conveniently accessible will make your experience smoother and much less stressful. By evaluating these crucial top qualities, you will be better positioned to find a mortgage broker that aligns with your home mortgage requirements.

Concerns to Ask Prospective Brokers

Selecting the appropriate home mortgage broker entails not only determining vital high qualities but likewise engaging them with the ideal inquiries to assess their proficiency and suitable for your requirements. Begin by inquiring about their experience in the industry and the sorts of fundings they focus on. This will certainly assist you recognize if they straighten with your details monetary circumstance and objectives.

Inquire concerning their procedure for assessing your monetary wellness and establishing the best home mortgage options. This inquiry reveals exactly how complete they remain in their method. In addition, ask about the range of loan providers they deal with; a broker who has accessibility to multiple lending institutions can supply you a lot more competitive prices and alternatives.

Understanding exactly how they are made up-- whether through upfront fees or commissions-- will certainly offer you understanding into possible problems of rate of interest. By asking these targeted inquiries, you can make a more enlightened choice and locate a broker that best matches your home car loan demands.

Researching Broker Credentials

Thoroughly researching broker credentials is an essential step in the mortgage option process. Ensuring that a home mortgage broker possesses the appropriate certifications and licenses can dramatically impact your Our site home financing experience.

Next, take into consideration the broker's educational history and specialist designations. Credentials such as Certified Home from this source Mortgage Professional (CMC) or Accredited Mortgage Specialist (AMP) show a commitment to continuous education and professionalism in the area. Furthermore, exploring the broker's experience can supply insight right into their know-how. A broker with a tried and tested performance history in effectively closing loans similar to your own is important.

Furthermore, check out any type of corrective activities or grievances lodged against the broker. On the internet reviews and testimonies can supply a peek right into the experiences of previous customers, aiding you evaluate the broker's credibility. Inevitably, thorough study right into broker credentials will encourage you to make a notified choice, cultivating confidence in your home loan procedure and enhancing your total home acquiring experience.

Assessing Costs and Providers

Reviewing fees and solutions is usually a vital component of picking the ideal home mortgage broker. Transparency in fee frameworks allows you to compare brokers successfully and evaluate the overall price of obtaining a mortgage.

In enhancement to fees, think about the range of solutions used by each broker. Some brokers supply an extensive collection of solutions, including monetary assessment, support with documentation, and recurring assistance throughout the financing procedure.

When evaluating a broker, ask about their availability, willingness, and responsiveness to respond to questions. A broker that focuses on customer service can make a considerable distinction in browsing the intricacies of home loan applications. Eventually, recognizing both fees and services will certainly equip you to pick a home mortgage broker that straightens with your economic demands and expectations, making certain a smooth course to homeownership.

Verdict

To conclude, selecting a official statement suitable home loan broker is vital for accomplishing favorable funding terms and a structured application procedure. By prioritizing brokers with solid credibilities, comprehensive experience, and access to several loan providers, people can enhance their opportunities of securing affordable prices. Furthermore, examining interaction abilities, fee structures, and overall openness will certainly add to a more enlightened decision. Ultimately, a knowledgeable and reliable home mortgage broker functions as an important ally in browsing the intricacies of the home loan landscape.

Selecting the right home mortgage broker is a crucial step in the home funding process, as the experience and resources they give can substantially influence your monetary result. Home loan brokers offer as intermediaries between loan providers and customers, facilitating the process of safeguarding a mortgage. Understanding the function and benefits of mortgage brokers inevitably encourages buyers to make informed decisions throughout their home mortgage trip.

Making sure that a home loan broker possesses the proper credentials and licenses can considerably impact your home funding experience. Ultimately, a knowledgeable and reliable home mortgage broker serves as a valuable ally in navigating the complexities of the home loan landscape.

Report this page